The World According to Ian Bremmer

Political scientist and global strategist Ian Bremmer provides his world view.

Interview by Bruce A. Percelay

Photography by Kit Noble

Ian Bremmer is the founder of the political research and consulting firm Eurasia Group, which primarily advises private sector enterprises on how to manage political risk. With offices around the world, Bremmer’s opinions are highly sought after, particularly during times of political instability. He has published 11 books, including the New York Times bestsellers, Us vs. Them: The Failure of Globalism, and The Power of Crisis: How Three Threats—and Our Response—Will Change the World.

Bremmer launched a digital media company called GZERO Media and the national public television show GZERO WORLD with Ian Bremmer on PBS. N Magazine sat down with Bremmer, a Nantucket summer resident, at his New York City headquarters for a wide-ranging discussion about the impact of President Donald Trump’s tariffs, our relations with our allies, the status of the war in Ukraine and the Middle East, as well as the state of democracy in America.

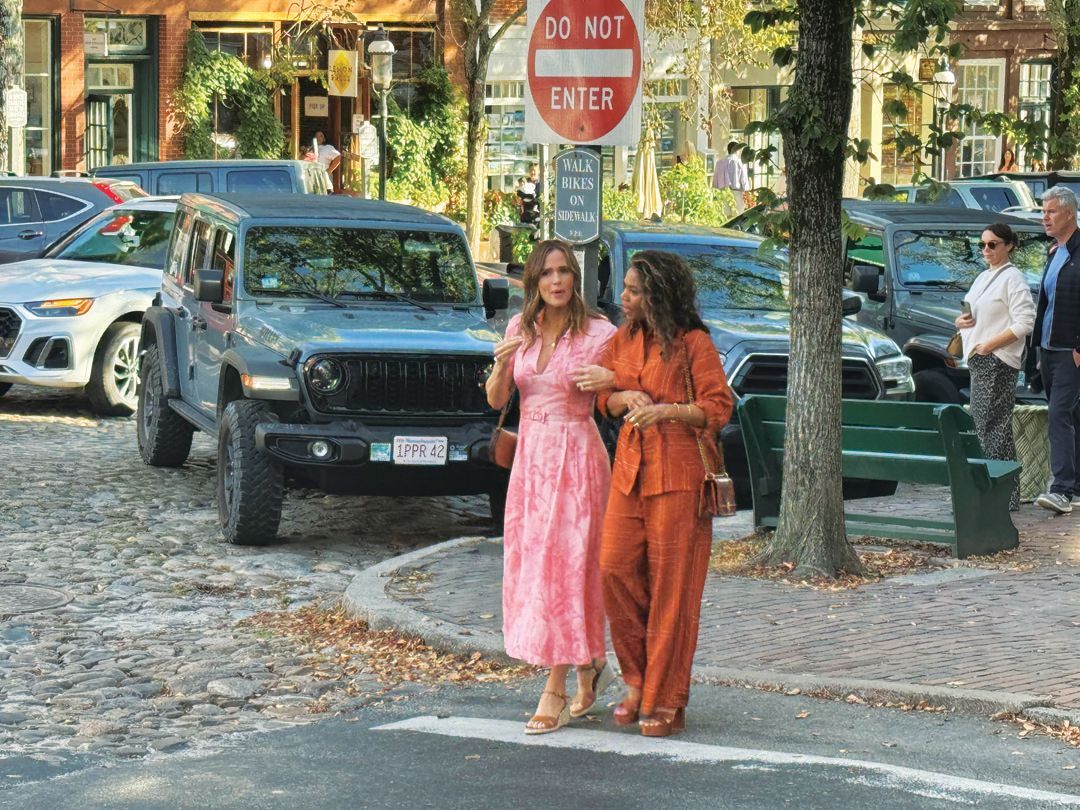

How did you end up on Nantucket?

I’m from Chelsea [Massachusetts]. I grew up in the projects and didn’t even know Nantucket existed. When I was a kid, someone once said, “Nantucket,” but I misheard them and thought they said, “Nantasket,” because I had been to Nantasket Beach. Much later in life, after I had set up my family and was finally ready to take a proper vacation—I was thinking about where I wanted to go. Someone said to me, “Why don’t you go to Nantucket, you would love it there,” knowing my New England roots. I look edit up online, found some places sight unseen, and rented a little cottage on Warren Street for a month. I took the ferry, and as I got off, I saw something that had only existed in my dreams before, and I said, “Clearly, this is the place for me.”

Do you feel that the U.S. has been unfairly treated by other countries in terms of tariffs, and is there a justification for leveling the playing field?

Broadly speaking, I would say no. The U.S. today is the wealthiest large-scale economy in the world by far. Look at the U.S. and our quality of life, our productivity and entrepreneurship compared to Europe over the last20 years. Europe is poorer than Mississippi. You have to look at that and say, how is it that these guys are taking advantage of us? The idea behind free markets and more open access is that the most powerful country and the largest economy in the world will do much better if it has access to all of the markets around the world. Trump has said that if a country is running a trade surplus against the U.S., that means they’re taking advantage of us, so we need to zero that out with tariffs. That’s the way it was formulated. But let me give you two counterexamples. There are countries around the world where the U.S. is running a trade surplus, Brazil and Australia, for example. By Trump’s own definition, that means that the U.S. is taking advantage of those countries. Well then, why did we just add 10% tariffs to those countries? That argument doesn’t hold.

Secondly, there are many countries in the world that are incredibly poor that run trade surpluses with the U.S. because they cannot afford our goods. Madagascar, Lesotho and Bangladesh are not going to buy high-end American products. They don’t have a market for that. We want their inexpensive textiles. That’s why we run a trade surplus with them. Adding massive tariffs to those countries does not help us. All that does is make those goods more expensive for the U.S.

China is the 800-pound gorilla in this trade war and they have taken a very hardline stance. Where do you see this going?

The Chinese understand that they are more dependent on the American economy than the U.S. is on the Chinese economy. A tit-for-tat trade war will hurt the Chinese economically more than it will hurt the U.S., but having said that, it would hurt the U.S. politically more than it would hurt China. The U.S. is a democracy, and the Chinese are not. America is a high-income country that’s not willing to take an awful lot of pain and we’re short-term in orientation. The Chinese are not. That’s the bet that the Chinese are taking, that they can outlast Trump.

What is your prediction as to how this gets resolved?

It’s going to be easy to come up with deals with almost every other country in the world to get to a yes, including by restructuring the USMCA [United States-Mexico-Canada Agreement] with Mexico and Canada. With China, it’s a lot harder. My level of uncertainty that we will fix this with China is very high. There’s no break-through, there’s no scenario where Trump and Xi Jinping get back together and we take the tariffs off. The two options are a complete decoupling, which is very messy and unmanaged, and leads to economic pain on both sides. Or there is a half deal without trust that brings us back to 60% tariffs instead of the 125% that we’re looking at now, where the Americans de-risk away from China and the Chinese de-risk away from the U.S.

For our lifetimes, we’ve lived in a world of U.S.-led globalization, a system of common values and standards and rule of law where we work to bring tariffs a slow as possible so that goods, services and capital can move across borders as fast and efficiently as possible. For the last 15-20 years, that system has persisted but without active U.S. leadership. You can point to the failure of the Trans-Pacific Partnership as the beginning of that, which was under President Barack Obama—and then Trump killed it. Now, you can say the U.S. is actively looking to dismantle the system of globalization and in its place live by the law of the jungle, where the U.S. can impose its standards on other weaker countries, and that it would remake that global order in our image. There are significant obstacles to making that work effectively.

The biggest fear on Wall Street is the bond market. Do you see a scenario where the bond market could turn it into something far more dangerous for the economy?

That’s what Trump responded to in April. He didn’t respond to two days of the stock market tanking; instead he responded to the bond vigilantes. He was worried we were heading to a global financial crisis. It was certainly plausible if he had stuck to his guns on the across-the-board tariff levels that were announced, and that was only the opening salvo. And he has credibility because he’s not running again and the Democrats have no popularity or leadership on these issues right now—and Trump is surrounded by loyalists who are not going to speak crosswise to him.

If he wanted to ignore the markets and lead to more pain, he could have, but he chose not to. For that reason I don’t think that there is a significant short-term risk of a self-induced global financial crisis, but there’s a large long-term risk that America is no longer trusted by countries around the world as a safe place to make long-term commitments. Long-term, we are taking steps to ensure that countries make smaller bets on the U.S., and it’s not just about tariffs. It’s also about Russia and Ukraine, about the way we treat foreign students and tourists. All of these things erode trust in the U.S.

Is the erosion of trust unique to Trump, or to his predecessors, as well?

It’s not unique to Trump. The erosion of trust has been happening incrementally for decades. You can point back to the global financial crisis, which started in American free markets. You can point to the wars in Iraq and Afghanistan, the longest war the U.S. has been in. We can point to a lot of things that have happened that have made Trump symptomatic, and also the biggest beneficiary of the fact that American trust has eroded.

At the end of the day, who is the winner? Will China emerge stronger 10 years from now?

When you’ve had a system of globalization that for the post-war period has unlocked unprecedented global growth, allowed a global middleclass to emerge, and allowed China to become a middle-income country—and then to undo that—that doesn’t create winners. It creates losers allover the world. The question is who are the bigger losers and who are the smaller losers. The U.K. is the smaller loser, ironically, because of Brexit, a major goal of the U.K. economy until now. Now, the fact that they’re not in the European Union gives them more flexibility vis-à-vis the U.S. China’s economy is significantly underperforming, and they’re going to get hurt in a big way by the pressure the U.S. is putting on them, not only directly but indirectly through third countries where the Americans are trying to squeeze trans-shipment. Long-term, as America tries to shutdown globalization, shut down USAID and aid in the global south—and as the U.S. supports Israel in a war where the majority of countries take the other side—China has other opportunities. If the U.S. pulls out of the Paris Climate Accord, the Chinese—who are driving new technologies in renewable energy—will become a dominant force, and America will be in the margins. If the U.S. pulls out of the WHO [World Health Organization], China will become the dominant country in future policies.

Does the current situation increase the risk of China invading Taiwan?

No, I don’t think so. China’s economy is doing badly right now and it will do worse because of this conflict. China is trying to become self-dependent on semiconductors as quickly as possible, but they are not there. Right now, they desperately need Taiwan and [the Taiwan Semiconductor Manufacturing Company] for their own economy. A conflict with the U.S. over Taiwan would cause unprecedented damage. The political pendulum has been swinging quite wildly in the U.S.

We’re now seeing Democrats coalesce around the growing unpopularity of Trump. Could you see the pendulum ultimately swinging back to the left?

Of course. Joe Biden was not capable of running again. He needed to be pushed out, and they needed an open primary. Kamala Harris was an incumbent, and when asked if she would do anything differently, she said she wouldn’t do anything differently and she lost. Canada is going through this. Justin Trudeau was the incumbent but unpopular. His deputy prime minister forced him out. She ran an open primary and lost. They’re now bringing in Mark Carney. In an environment where incumbency has become a singular disadvantage, you’re going to see bigger swings, and that’s a vulnerability Trump has as we look to the midterms.

The amount of money saved by Elon Musk and his Department of Government Efficiency seems to be relatively small at this moment. Is it a political pipe dream to reduce the deficit in a meaningful way?

Virtually no one in Congress is interested in reducing the deficit. They all have things they want to spend money on. President Trump himself has no problem running deficits. He doesn’t like trade deficits, but he has no problem with budget deficits. That’s a drag on the U.S. economy if you’re no spending money wisely. Look at the wars in Afghanistan and Iraq. That’s trillions of dollars that should have been spent on the American people. There’s a lot of fat in the U.S. government. DOGE is going to reduce the workforce by something like 10%. That’s not a rounding error—it matters, and it’s not going to significantly undermine the ability of the U.S. government to produce. But where DOGE could be more effective is in using artificial intelligence inside the government systems to identify regulatory overlap and inefficiency.

I also see DOGE driving ideological programs. The things they’re trying to cut are because they are perceived to be progressive, woke or connected to Biden. That creates a chainsaw as opposed toa scalpel approach. There was waste in USAID, but there were also things that were cut that are going to kill millions of people. I see DOGE as a double-edged sword, and I’m deeply uncomfortable with the idea that the person in charge of DOGE is also a Trump donor and the richest person still in the private sector. That strikes me as kleptocratic and a conflict of interest.

Does the national debt blow up at some point if we cannot manage it?

I don’t think we know. You can look at the basic numbers around Medicare and say the population is changing. The number of older people is becoming greater, which requires you to change the nature of the program, when people get benefits and what those benefits are. But we also know that American productivity gains through entrepreneurship and advanced technology are far greater than what we’re seeing in Europe. We know China is not an attractive place to store wealth because they have much less transparency into their systems. To say the U.S. is going to become unsustainable implies that people are going to go someplace else, and you have to tell me where that is. We don’t yet have that other place.

What is your view of where we will be a year from now based on current policies in Washington and their impact on the economy?

The biggest question for the U.S. in the next year is not about the economy, but about the political system. The U.S. is already by far the most coin-operated, kleptocratic political system of any advanced industrial democracy. The reason we got Trump is because so many people already believed the U.S. didn’t have a functioning democracy. Trump is the principal beneficiary of that, but he’s not trying to fix it. When you see his willingness to weaponize a number of departments like the DOJ, FBI and the IRS against his political enemies, you have to start asking whether the U.S. persists in terms of its fundamental rule of law, or whether we have a constitutional crisis. That’s where you have to look at whether the judiciary will stand up and contain an executive that doesn’t want to adhere to its rulings.

Trump is under fire for many things he is doing but are there aspects of his agenda you think are positive?

Applying artificial intelligence into government operations (through DOGE), increasing efficiency and reducing regulatory overreach and overlap is extremely important, and other countries around the world will try to follow a similar strategy. Trump's orientation towards ending wars is important. Trying to bring the war in Ukraine to an end is overdue and welcome. I'm also glad to see Trump leaning into diplomacy with Iran, with the intention of a broader deal.

Some feel democracy is threatened under Trump? What is Your View?

It’s in more trouble than at any other point in my lifetime, but that’s different from saying it’s about to collapse. I don’t think we’re on the precipice of a civil war, or becoming a dictatorship. The U.S. is not going to be Russia over the course of Trump. We still have an independent, professional military, a federal system with elections run state by state, and a Supreme Court that rules independently even today. There have been decisions in the last week that are unprecedented in undermining some fundamental pillars of American democracy.

Long-term, are you optimistic about where the country is going?

Long-term, I’m an optimist. The power of new technologies that will unlock human capital is transformative and coming fast. We’re actually creating solutions faster than we’re creating problems. It’s an amazing time to be a kid right now. I think 2040 or 2050,in a world with at-scale, inexpensive, decentralized, abundant sustainable energy for everyone—that’s amazing in terms of wealth and what you can do with it. I think about what AI is capable of doing in terms of anyone around the world having access to world-class knowledge and solutions for education, medication and self-development. How can you not be an optimist in that environment.